The global semiconductor supply chain in 2026 will still need to navigate complex external dynamics, resulting in both unprecedented opportunities and persistent challenges.

After several years marked by the pandemic, trade restrictions, and geopolitical tensions, the supply chain requires resilience, diversification, and long-term planning have become the guiding principles.

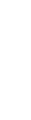

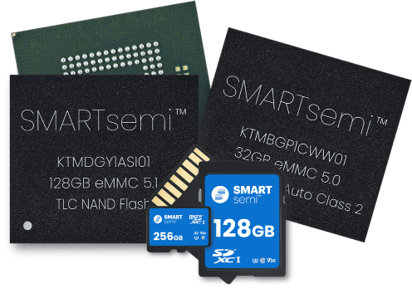

SMARTsemi’s expanded eMMC product offerings now include eMMC 5.1 storage devices as small as 2Gb and up to 256GB capacity. Speeds run up to 330 MB/s Sequential Read and 21,000 Sequential Write.

And operating ranges include commercial, industrial, wide, and automotive. Check out the product line and start your qualification today with a request for free samples!

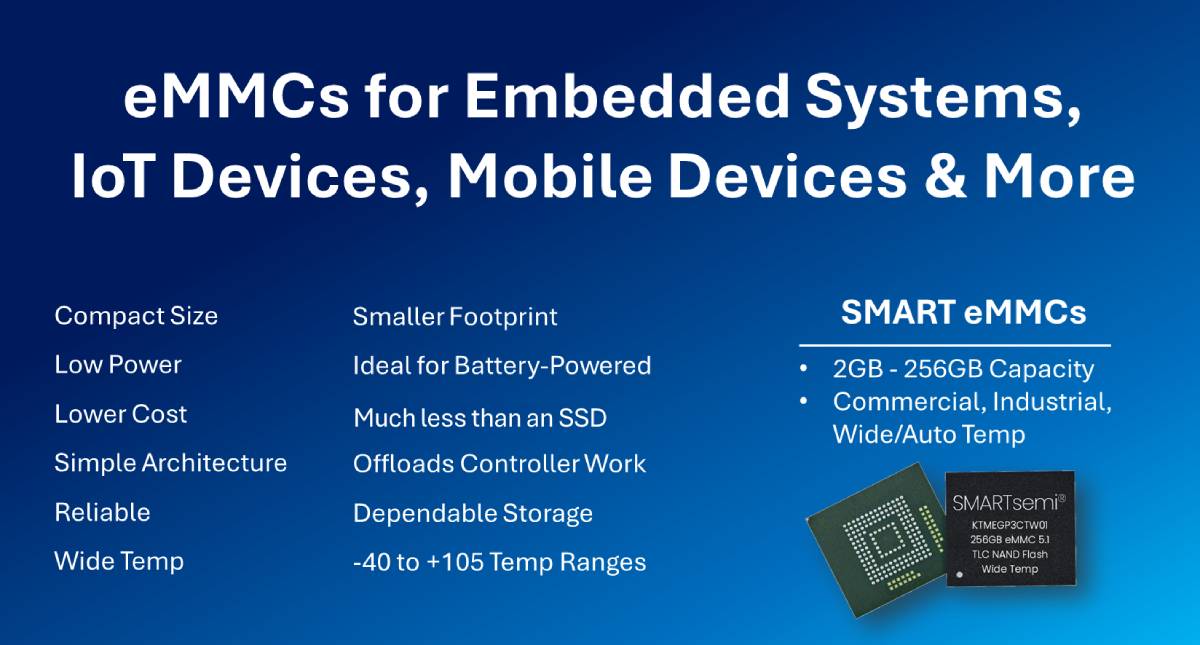

The past year has been challenging for memory suppliers. Independent analysts report that customer inventory levels have been depleting while demand has been increasing. Supplier production levels and capacity investments have been cut back.

Additionally, a new post-COVID supply/demand balance has been reached with price stabilization after price declines not seen in 15 years.

The Changing Market

Industry pundits forecast that suppliers will be slow to increase capacity as they need time to recover. DDR4 supply is expected to tighten as mainstream demand shifts to DDR5. And eMMC growth is expected to continue. Price increases are projected to resume and accelerate as we enter a period of undersupply by 2024.

Now is the time to ensure your supply is stable for the period ahead. Qualify SMARTsemi DRAM, eMMC, and Flash Cards today.

As your supply chain partner, we understand your challenges sourcing components for long-life applications, and we’ve aligned our priorities with yours, including long term relationships and supply agreements with Tier-1 manufacturers.

SMARTsemi is a premier source of commercial, industrial, and wide/automotive temperature grade memory components. From legacy to mainstream, our DRAM and FLASH eMMC devices and SD Cards are processed for the high-reliability and quality that long-life applications need.

Our digital platform is designed to minimize your effort to search, select, sample, and source products from our authorized stocking distributors or from us.

Your search for a component doesn’t end with SMARTsemi part numbers. Through SMARTsemi SOURCEplus we secure inventory for you from other Tier-1 and quality suppliers when a SMARTsemi part is not available.

Put our team to work for you. We’re not just a supplier, we’re your trusted sourcing partner.